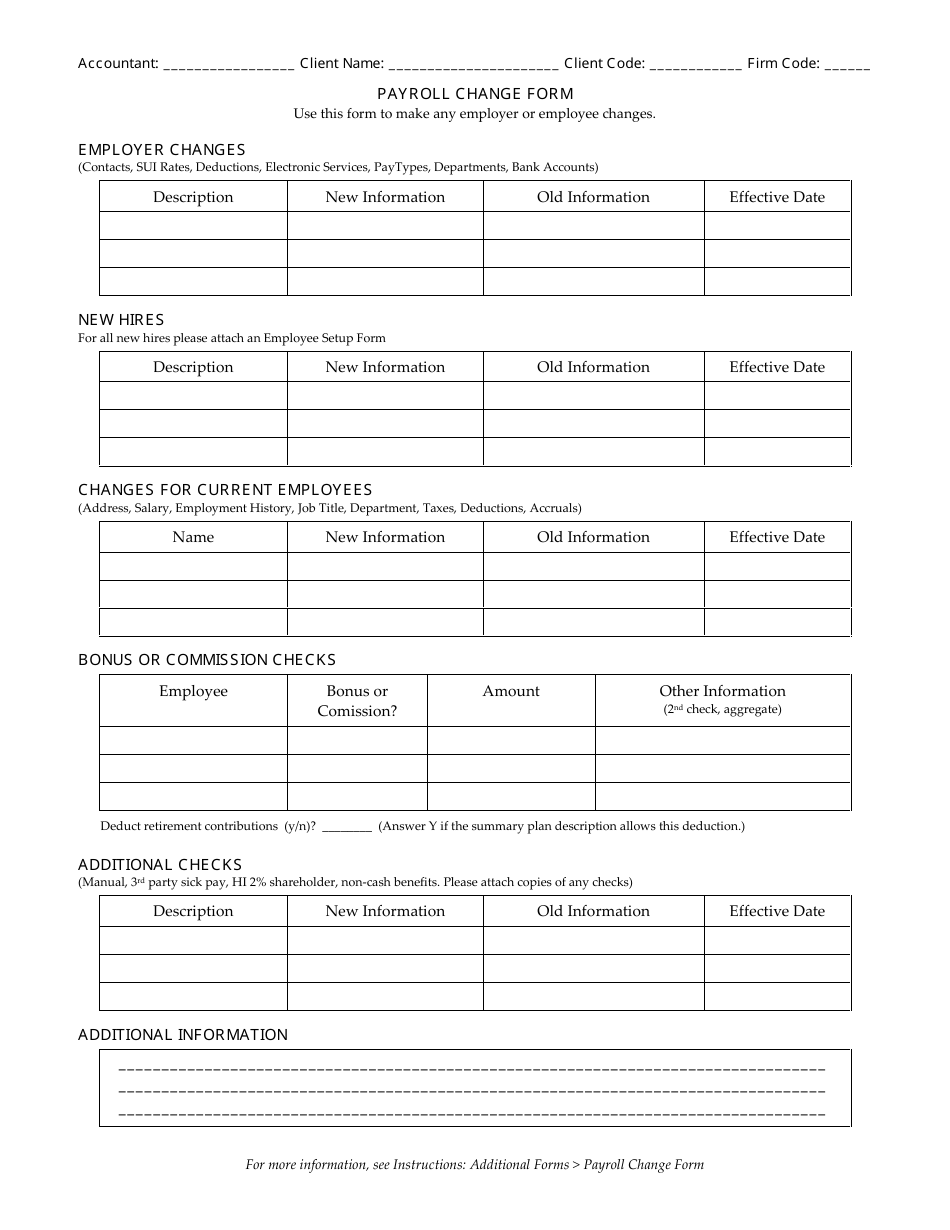

The Payroll Change Form - Table is used to make changes to an employee's payroll information, such as their salary, deductions, or tax withholding.

The Payroll Change Form - Table is typically filed by the employer or the human resources department within a company.

Q: What is a payroll change form?

A: A payroll change form is a document used to request changes to an employee's payroll information.

Q: Why would I need to fill out a payroll change form?

A: You would need to fill out a payroll change form to update your personal or bank account information, adjust your tax withholding, or make changes to your direct deposit settings.

Q: What information do I need to provide on a payroll change form?

A: You will need to provide your full name, employee ID or social security number, the type of change you are requesting, and any supporting documentation, such as a voided check for bank account changes.

Q: How long does it take for payroll changes to take effect?

A: The time it takes for payroll changes to take effect can vary depending on your employer's payroll processing timetable. It is best to check with your employer for specific timelines.

Legal Disclaimer: The information provided on TemplateRoller.com is for general and educational purposes only and is not a substitute for professional advice. All information is provided in good faith, however, we make no representation or warranty of any kind regarding its accuracy, validity, reliability, or completeness. Consult with the appropriate professionals before taking any legal action. TemplateRoller.com will not be liable for loss or damage of any kind incurred as a result of using the information provided on the site.

TemplateRoller. All rights reserved. 2024 ©

This website or its third-party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy.