- The farmhouse is occupied by the cultivator or receiver of rent from land.

- The farmhouse is located in the immediate vicinity (near) of the agricultural land.

- The farmhouse is used as storehouse or out-house or dwelling house. But, if the income from farmhouse is through letting out for residential purposes or for any business purposes, such income is not an agricultural income.

Is Agricultural Income exempted from Income Tax for FY 2023-24?

As we are clear about what is an agricultural income, let’s now understand the scenarios where income from agriculture is totally tax-exempt;

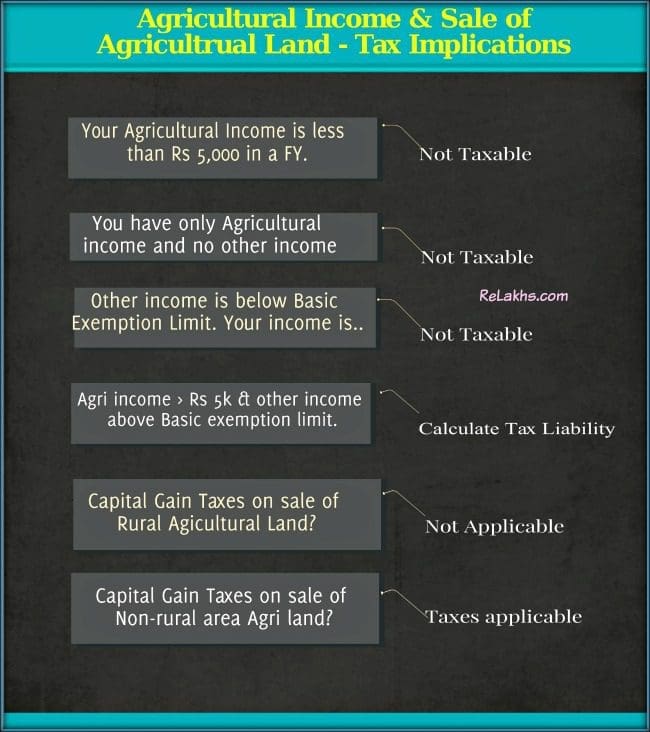

- If your agricultural income is less than Rs 5,000 in a Financial Year, it is tax free.

- If agriculture is your only source of income , such income is tax exempt.

- If you have agricultural income and also have other income from salary/business , and the total income excluding agricultural income is less than basic income exemption limit then there will be no tax liability.

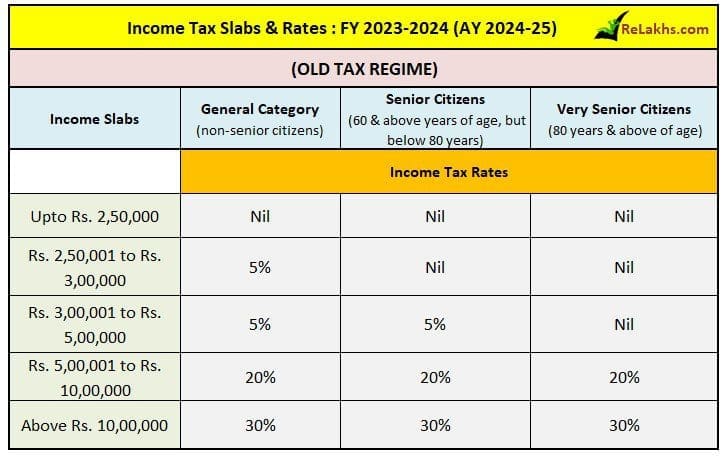

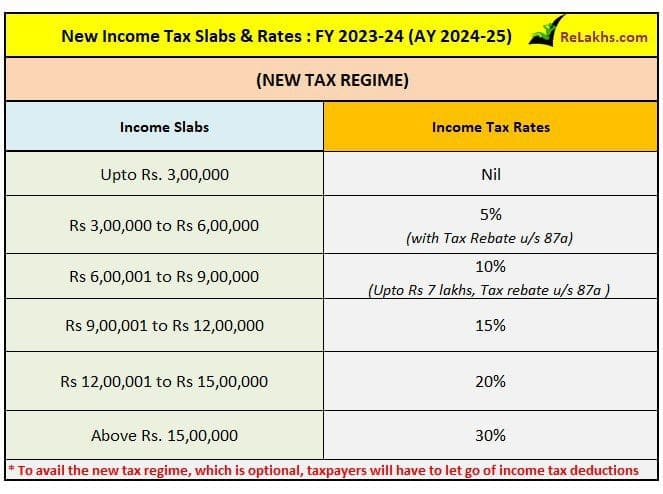

For the Financial Year 2023-24 (AY 2024-25), the basic exemption limit under the old tax regime is Rs 2.5 lakh and for the new tax regime it is Rs 3 Lakhs.

How to calculate Income Tax on Agriculture Income AY 2024-25?

What if your agricultural income is more than Rs 5,000 and if you also have income from salary / business / profession which is above the basic exemption limit?

In this scenario, your agricultural income has to be added (included) to the total income while calculating the tax liability for the given Financial Year (FY) .

Below is the procedure to calculate the tax liability by taking Agricultural income into account;

- Step 1 – Add Agricultural income and other sources of income.

- Step 2 – Compute income tax (A) on the above aggregate income as per the applicable income tax rates.

- Step 3 – Add Agricultural income to the applicable basic exemption limit.

- Step 4 – Compute income tax (B) on the above aggregate income at the income tax rates prescribed.

- Step 5 – Income tax liability is A – B .

Let’s understand this with a simple example . Mr Reddy (35 years) is having Business income of Rs 4,00,000 and net agricultural income of Rs 90,000/-. What is the income tax liability of Mr Reddy for AY 2024-25, under old tax regime.

In the above scenario, the agricultural income is above Rs 5,000 and the other income is above the basic exemption limit. So, we need to include agricultural income to total income when computing tax liability.

- Add Agricultural income and other sources of income. Aggregate income = Rs 4,00,000 + Rs 90,000 = Rs 4,90,000 .

- Compute income tax (A) on the above aggregate income as per the applicable income tax rates. Income tax liability on Rs 4.9 Lakh is Rs 12,000. (Up to Rs 2.5 Lakh no tax and tax @ 5% on the remaining Rs 2.4 Lakh. Education cess ignored.)

- Add Agricultural income to the applicable basic exemption limit. Aggregate income = Rs 90,000 + Rs 2.5 Lakh = Rs 3,40,000 .

- Compute income tax (B) on the above aggregate income as per the applicable income tax rates. Income tax on Rs 3.4 Lakh is Rs 4,500. (Up to Rs 2.5 Lakh no tax and tax @ 5% on the remaining Rs 90,000. Education cess ignored.)

- Mr Reddy’s income tax liability is Rs 12,000 – Rs 4,500 = Rs 7,500 .

- Please note that Rebate u/s 87A, surcharge, Cess will be applicable in addition to the tax calculated. Standard deduction is applicable for salaried individuals.

So, it is clear that even though agricultural income is exempted under IT act, in actual practice it is not the case. Also, if you are in say 20% tax bracket, addition of agricultural income may take you to 30% tax slab rate. So, agricultural income is considered for determining the applicable income tax slab rate.

Income tax implications on Sale of Agricultural Land AY 2024-25

Land is a capital asset. Capital asset typically refers to anything that you own for personal or investment purposes. It includes all kinds of property; movable or immovable, tangible or intangible, fixed or circulating.

When you sell a capital asset, the difference between the purchase price of the asset and the amount you sell it for is a capital gain or a capital loss. Capital gains and losses are classified as long-term or short-term .

So is Agricultural land a Capital Asset? Do you need to pay income tax on sale of your agricultural land?

If your agricultural land is in rural area, such land is not treated as Capital asset and hence no capital gain taxes are levied. Agricultural land in Rural Area India is not considered a capital asset. Therefore any gains from its sale are not taxable under the head Capital Gains.

Definition of Rural Area as per Income Tax Act – Any area which is outside the jurisdiction of a municipality or cantonment board having a population of 10,000 or more is considered Rural Area, if it does not fall within distance (to be measured aerially) given below;

- 2 kms from local limit of municipality or cantonment board and If the population of the municipality/cantonment board is more than 10,000 but not more than 1 lakh.

- 6 kms from local limit of municipality or cantonment board and If the population of the municipality/cantonment board is more than 1 lakh but not more than 10 lakh

- 8 kms from local limit of municipality or cantonment board and If the population of the municipality/cantonment board is more than 10 lakh.

So, if your agricultural land falls in Urban Area (non-rural area) then Capital Gain Tax is applicable.

Capital Gain Tax on Sale of Urban Agricultural Land (non-rural area)

If Agricultural Land is held for 24 months or less then that Asset is treated as Short Term Capital Asset. You, as an investor will make either Short Term Capital Gain (STCG) or Short Term Capital Loss (STCL) on that investment. Short term capital gains on Agricultural land will be taxed as per applicable income tax slab rate .

If Land is held for more than 24 months (w.e.f. FY 2017-18 / AY 2018-19) then that Asset is treated as Long Term Capital Asset. You will make either Long Term Capital Gain (LTCG) or Long Term Capital Loss (LTCL) on that investment. Long term capital gains on Agricultural land is taxed at 20%. (Read : ‘ How to calculate Capital Gains on sale of Land? ‘)

How do I save Capital Gains tax on sale of Urban Agricultural Land AY 2024-25?

You can claim below deductions to lower the tax liability on capital gains of sale of Agricultural land;

- Deduction Under Section 54B

- If you sell an agricultural land and make capital gains, you can re-invest such gains in acquiring another agricultural land. You have to buy another agricultural land within 2 years.

- This deduction is available only if you/your parents have been using the agricultural land for a period of two years prior to date of transfer (sale) . (Exemption U/s. 54B on Sale of agricultural land available even if land is cultivated for a part of year during two immediately preceding years.)

- The new agricultural land that is acquired should be held by you for atleast 3 years from the date of purchase.

- With effect from Assessment Year 2024-25, the Finance Act 2023 has restricted the maximum exemption to be allowed under Section 54F. In case the cost of the new property (capital asset) exceeds Rs. 10 crores, the excess amount shall be ignored for computing the exemption under Section 54. Up to FY 2022-23, there was no tax exemption ceiling limit u/s 54F.

- If you sell land and make long-term capital gains, you can re-invest the sale proceeds to purchase a residential house within 1 year before or 2 years after from the date of sale of land or you should construct the residential house within 3 years from the date of sale.

- You should not own more than one residential house on the date of transfer of land.

- If you sell agricultural land and make long-term capital gains, you can re-invest Capital Gain amount to purchase NHAI or REC bonds within 6 months from the date of transfer.

- The maximum allowed investment is Rs 50 Lakh.

- The bonds should not be sold/transferred for 3 years.

Important Points & FAQs on Agricultural Income & Sale of Agricultural Land

- The Central Government can’t impose or levy tax on agricultural income. The exemption clause is mentioned under Section 10 (1) of the Income Tax Act of India. However, state governments can impose tax on Agricultural income.

- Under Section 10(37) of the Income Tax Act, Capital Gains on compensation received on compulsory acquisition of urban agricultural land is exempt from tax. This exemption is available if the land was used by the taxpayer (or by his parents in the case of an individual) for agricultural purpose for a period of 2 years immediately preceding the date of its transfer.

- Is rebate 87A applicable on agricultural income? – Yes. The resident individuals earning from agricultural income sources are eligible to claim tax rebate under section 87A.

- I have agricultural income as the only source of income, should I file income tax return? – It is not required to file IT returns if agriculture is your only source of income. But filing Income Tax Return has its own advantage so you may consider filing your taxes.

- I s 1% TDS on sale of agricultural land is applicable? – 1% TDS is not applicable on sale of Agricultural land.

- I have Agricultural income of more than Rs 5,000, which ITR form should I file? – Agricultural revenue should be reported in ITR 1 under the Agriculture Income column. However, ITR 1 can only be used if your agricultural income is less than Rs 5,000. If the stated income exceeds this limit, form ITR-2 must be filed.

- Can I carry forward capital losses? – Yes, capital losses from agricultural operations can be carried forward and set off with agricultural income of next eight assessment years.

- I am a sub-tenant or tenant of agricultural land, is my agricultural income tax-free? – Kindly note that ownership of land is not essential. All tillers of land are considered as agriculturalists and enjoy exemption from tax.

- Income from trees that have been cut and sold as timber is not considered as an agricultural income since there is no active involvement in operations like cultivation and soil treatment.

- Dairy / poultry Farming, income from supply of water for irrigation purpose, income from sale of earth for brick-making, rental income from Farmhouse given for non-agricultural purposes etc., are not considered as an agricultural income.

- Is Agricultural income taxable for an NRI in India? – NRI’s cannot purchase agricultural land, plantation or farm land in India. If an NRI is willing to purchase agricultural land in India, it requires permission from the Reserve Bank of India for doing so. However, NRIs can inherit and hold agricultural land. Any agricultural income derived from such land is tax exempt. (While this type of income is exempt from tax, it is nonetheless included in the total income for arriving at slab rate purposes.)

- Is foreign agricultural income tax exempted? – Foreign agricultural income is not entitled for exemption and it is chargeable to tax under the head ‘income from other sources’.

I have tried my best to provide all tax related matters of Agricultural income & on sale of Agricultural land in a simple and easy to understand manner. Hope this is useful!

Do you believe that agricultural income should not be exempted from income tax? Is agricultural income one of the root causes of generation of domestic black-money? Kindly share your views and comments. Thanks!

Continue reading:

- Capital Gains Tax Exemption Options on Sale of House or Plot | Latest Rules

- Income Tax Deductions List FY 2023-24 | Under Old & New Tax Regimes