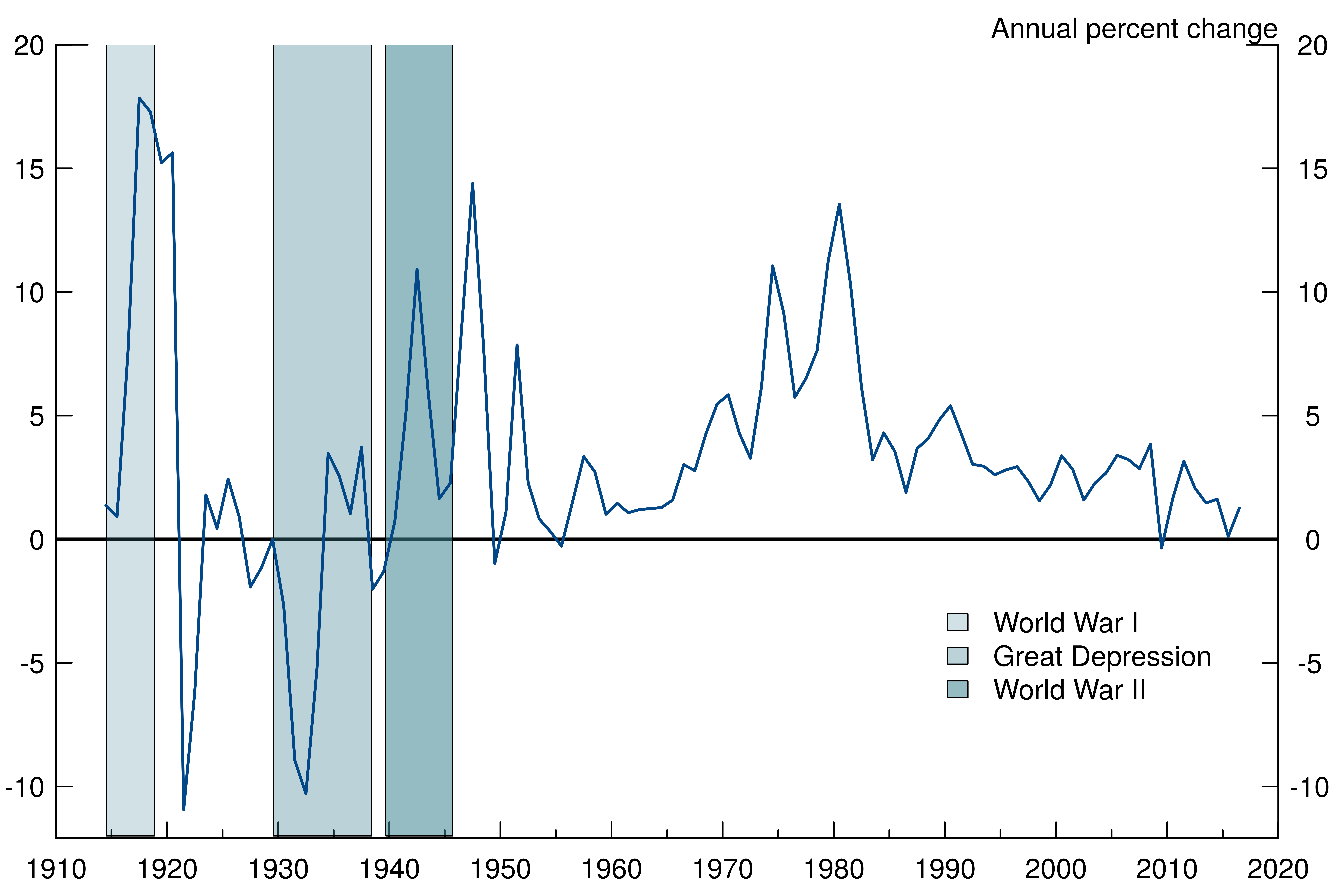

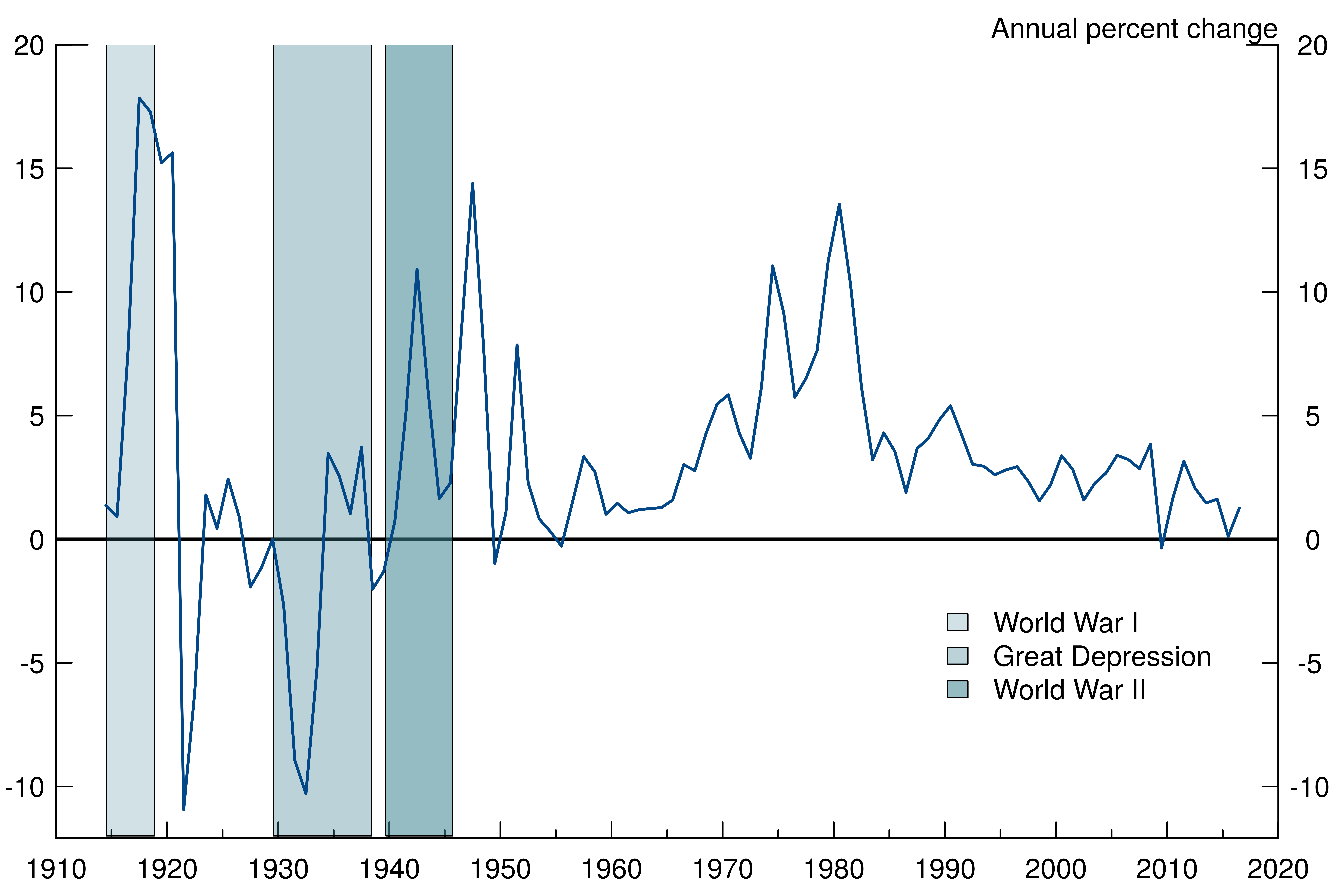

Over the past century, the United States has experienced periods in which the overall level of prices of goods and services was rising--a phenomenon known as inflation--and rare periods in which the overall level of prices was falling--a phenomenon known as deflation. Consumer prices fell sharply after World War I and during the first several years of the Great Depression (see figure 1). Consumer prices rose at an increasingly rapid rate in the 1970s and early 1980s, with inflation exceeding 10 percent per year for a time. By contrast, since the mid-1980s, consumer price inflation generally has been low and fairly stable.

U.S. households that experienced large and rapid changes in consumer prices, both increases and decreases, generally saw these movements as a major economic problem. In part, some of these price changes were symptomatic of deeper economic woes, such as soaring unemployment during the Great Depression. Moreover, large price movements can be costly in and of themselves. When prices change in unexpected ways, there can be transfers of purchasing power, such as between savers and borrowers; these transfers are arbitrary and may seem unfair. In addition, inflation volatility and uncertainty about the evolution of the price level complicates saving and investment decisions. Furthermore, high rates of inflation and deflation result in the need to more frequently rewrite contracts, reprint menus and catalogues, or adjust tax brackets and tax deductions. For all of those and other reasons, price stability--or low and stable inflation, as it is understood nowadays--contributes to higher standards of living for U.S. citizens. 1

Although many factors can affect the level of prices at any point--including the ups and downs of the economy, global commodity prices, the value of the dollar, taxes, and so on--the average rate of inflation over long time periods is ultimately determined by the central bank (see Monetary Policy: What Are Its Goals? How Does It Work?). Whether prices rise or fall, on average, over time, and how rapidly, reflects the interplay between the overall demand for goods and services and the costs of producing goods and services. In particular, a combination of persistently stronger growth in demand for goods and services than in capacity to produce them can lead to rising inflation, especially when people come to expect rising inflation. Conversely, persistently weak demand for goods and services can lead to deflation, especially when people expect prices to continue falling. Monetary policy, through its effects on financial conditions and inflation expectations, affects growth in the overall demand for goods and services relative to growth in the economy's productive capacity and thus plays a key role in stabilizing inflation and the economy more broadly. Moreover, monetary policy is most effective when the public is confident that the central bank will act to keep inflation low and stable. 2

Historically, in efforts to ensure that central banks managed financial conditions in a way consistent with achieving low and stable inflation over time, various nominal anchors have been adopted or proposed in the United States and other countries. A nominal anchor is a variable--such as the price of a particular commodity, an exchange rate, or the money supply--that is thought to bear a stable relationship to the price level or the rate of inflation over some period of time. The adoption of a nominal anchor is intended to help households and businesses form expectations about the conduct of monetary policy and future inflation; stable inflation expectations can, in turn, help stabilize actual inflation.

Prominent historical examples of nominal anchors

One prominent example is the gold standard, which, at the time the Federal Reserve was founded in 1913, served as the nominal anchor for much of the world, including the United States. Under the gold standard, the central bank commits to exchanging, on demand, a unit of domestic currency (for example, one dollar) for a fixed quantity of gold. As a result, the amount of money in the economy rises or falls in correspondence with the amount of gold in the central bank's vaults. If gold production keeps up with economic growth and the gold-currency convertibility is dutifully maintained, the price level can be expected to be roughly stable.

A related example is the maintenance of a fixed exchange rate. In a fixed exchange rate regime, the monetary authority offers to buy or sell a unit of domestic currency for a fixed amount of foreign currency (as opposed to a fixed amount of gold, as in the case of the gold standard). 3 Over time, a country that maintains a fixed exchange rate typically has about the same inflation as the foreign economy to which the exchange rate is fixed. For this reason, countries with histories of high or volatile inflation have often considered linking their monetary policy via a fixed exchange rate to that of a large country, such as the United States or Germany, that has been comparatively successful at achieving low and stable inflation.

Another example of a nominal anchor is money supply targeting. Under this approach, the central bank expands the money supply at a pre-specified, and typically fixed, rate over time. By controlling the expansion of the money supply, the central bank expects, in turn, to limit changes in the inflation rate. 4 To help reduce the inflation rate from the elevated levels experienced in the 1970s, many central banks, including the Fed, incorporated such targets into their policy frameworks. 5

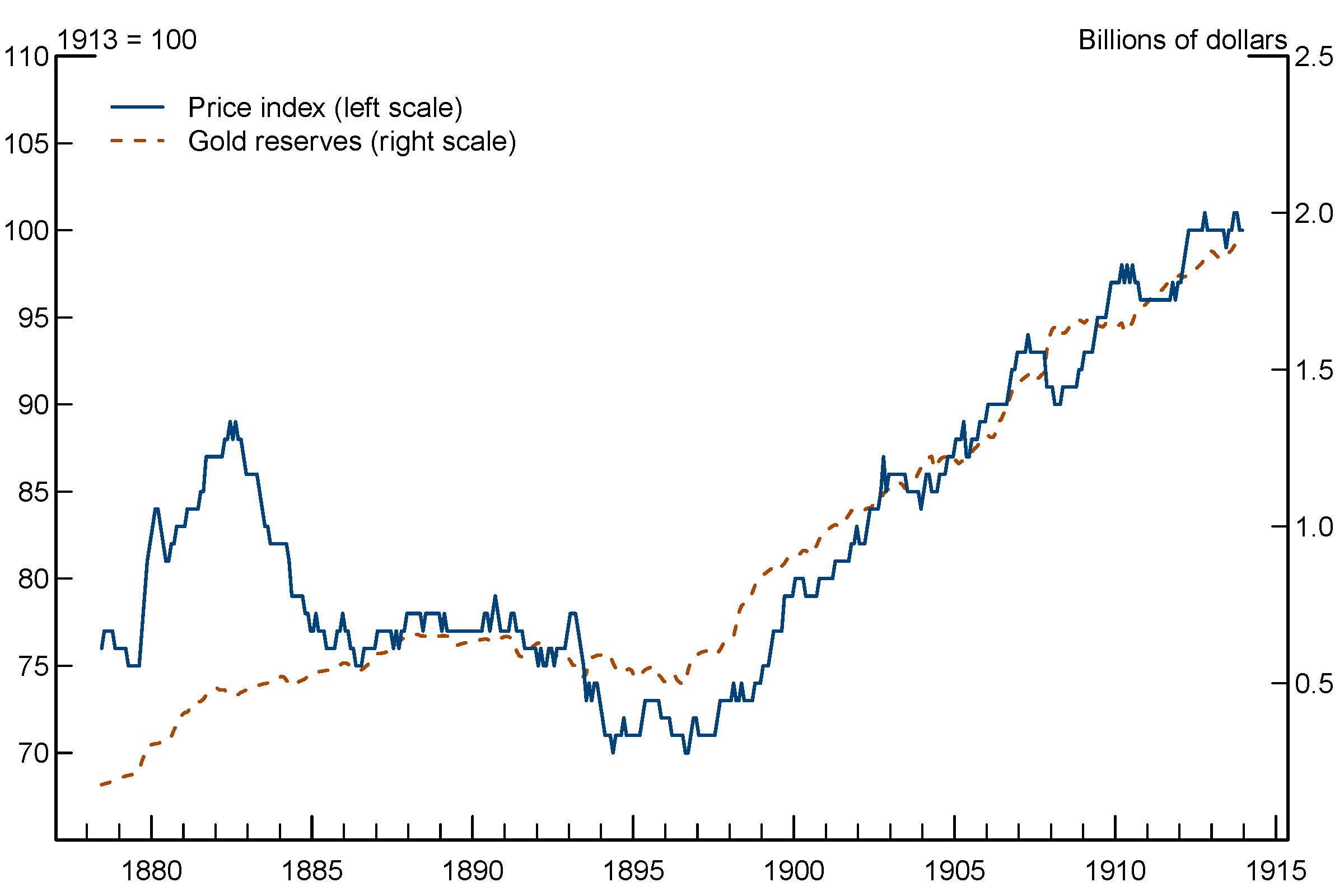

In practice, the experience of the United States and other countries with these nominal anchors has highlighted several practical challenges. In the case of the gold standard, the maintenance of convertibility on demand between currency and gold was not always consistent with price stability. The United States tended to experience deflation when gold production did not keep up with the pace of economic expansion and, conversely, to experience inflation when gold production ran ahead of economic growth. For example, the advent of the cyanide extraction process, which increased the amount of gold recovered from low-grade ore, and major gold discoveries in Alaska, South Africa, and elsewhere boosted the supply of gold and helped lift the U.S. price level early in the 20th century, as figure 2 illustrates. 6 Because gold could easily be shipped between countries, gold discoveries anywhere in the world could fuel U.S. inflation.

A further challenge is that the policies required to maintain the gold standard sometimes hurt employment and economic activity, in particular during periods of economic turmoil. Many central banks kept a careful watch on their gold reserves, in part because the amount of gold in their vaults often was smaller than the outstanding volume of currency in circulation. This situation created an incentive for people to preemptively exchange their currency for gold whenever they worried that the central bank might run out of gold. To deter runs on their gold reserves and preserve the gold standard, central banks at times sought to attract gold by raising interest rates. Higher interest rates provided an incentive for investors--both domestic and foreign--to exchange their assets abroad for gold, ship that gold to the country that had raised interest rates, and, finally, exchange that gold for domestic currency at the central bank in order to invest in higher-yielding domestic assets. Higher interest rates would, however, slow the economy and increase unemployment. Indeed, the use of such policies to maintain the gold standard in the 1930s likely exacerbated the Great Depression in a number of countries, including the United States, which eventually led to the demise of the gold standard and to efforts to create more adequate monetary frameworks in the post-World War II era. 7

Fixed exchange rate regimes tend to involve challenges like those of the gold standard. Under fixed exchange rates, the ability of a central bank to use monetary policy to respond to domestic economic circumstances is subordinated to the need to maintain the exchange rate at the targeted level. For fixed exchange rate regimes to be sustainable, people must be confident that the central bank has the ability to convert domestic money into foreign currency on demand (by holding sufficiently large foreign currency reserves) and the will to defend the exchange rate against speculative attacks (by raising interest rates even if it would cause the economy to fall into recession). Otherwise, people may preemptively attempt to shift their domestic-currency assets into foreign-currency assets to preserve their wealth, triggering a crisis in the foreign exchange market. Indeed, many fixed exchange rate regimes have ended in crisis because investors concluded that the monetary policy needed to achieve domestic policy objectives was incompatible with the monetary policy pursued by the anchor-currency country and judged that the domestic central bank would place a higher priority on achieving domestic objectives than on maintaining the exchange rate. 8

The main challenge associated with targeting the growth of the money supply was of a different nature. Many central banks, including the Fed, that attempted to incorporate a money supply target as part of efforts to rein in inflation in the 1970s and 1980s found that the relationship between inflation, economic activity, and measures of money growth was unstable. This period was one of rapid innovations and transformations in the financial sector. 9 Partly as a result, the rate of money growth consistent with price stability became highly uncertain.

Lessons from history for the pursuit of price stability today

One key lesson from historical experience with the gold standard, fixed exchange rates, and money growth targets is that tying monetary policy to these nominal anchors need not stabilize the price level or inflation. Notably, unstable economic relationships (such as between inflation and money growth) or external factors (such as gold discoveries and economic development abroad) can stand in the way of price stability even when these anchors are successfully maintained. Moreover, the policies required to maintain these anchors did, at times, lead to highly undesirable outcomes, as exemplified by the economic downturns that ensued when the public lost confidence in a central bank's ability to maintain the gold standard or a fixed exchange rate and the central bank attempted to preserve the anchor through tightening monetary policy sharply.

Today the nominal anchor in the United States is the Federal Open Market Committee's (FOMC) explicit objective of achieving inflation at the rate of 2 percent per year over the longer run. This goal is supported by a policy strategy by which the FOMC responds to economic developments in a way that systematically aims to return inflation to 2 percent over time. 10 By aiming to achieve low and stable inflation (as opposed to maintaining a particular price of gold or foreign exchange or a particular growth rate of the money supply), the FOMC has the flexibility to adapt its strategy as its understanding of the economy improves and as economic relationships evolve. The FOMC's strong commitment to its inflation objective helps crystalize the public's longer-run inflation expectations around that objective, which, in turn, helps keep actual inflation near 2 percent. This commitment further gives the FOMC room to support employment and makes monetary policy a more potent force for stabilizing the economy overall.

1. Deflation can entail additional economic costs. An unanticipated fall in the price level can make it more difficult for borrowers to repay debts. For example, when prices fall unexpectedly, a firm will receive fewer dollars when it sells its products than it had anticipated, leaving it with fewer resources to service its debts. Also, a reluctance to adjust wages down in the face of deflation may choke off job creation and economic activity. Moreover, the ability of the Federal Open Market Committee (FOMC) to lean against the adverse effects of deflation through cuts in its target for the federal funds rate becomes limited once the target has been reduced to zero. This limited ability is a primary reason why the FOMC sees modestly positive yearly inflation at the rate of 2 percent―as distinct from a constant price level―as most consistent with its statutory mandate. That said, 2 percent is sufficiently away from deflation that the FOMC sees the costs of positive and negative deviations from that inflation goal as symmetric. Return to text

2. Such confidence helps the Fed stabilize both inflation and economic activity. For example, if the public were to observe an increase in inflation and lacked confidence that the Fed would act to bring inflation back down, then inflation expectations could move higher. The Fed would then need to tighten monetary policy more than otherwise to rein in the increase in inflation, which could lead to a recession. Return to text

3. Versions of this regime call for letting the exchange rate appreciate or depreciate at a preannounced constant rate or evolve within a narrow band so as to stabilize the domestic inflation rate. A more extreme version is when a country gives up its domestic currency altogether so that its monetary policy is set by some other authority. Countries that have "dollarized" their economies (for example, Ecuador and El Salvador) or that share their monetary policy with other countries, such as the members of the euro area, fall into that latter category. Return to text

4. See Milton Friedman (1982), "Monetary Policy: Theory and Practice," Journal of Money, Credit, and Banking, vol. 14 (February), pp. 98-118; and Edward Nelson (2008), "Friedman and Taylor on Monetary Policy Rules: A Comparison (PDF)," Federal Reserve Bank of St. Louis, Review, vol. 90 (March/April), pp. 95-116. Return to text

5. See Ben Bernanke and Frederic Mishkin (1992), "Central Bank Behavior and the Strategy of Monetary Policy: Observations from Six Industrialized Countries," in Olivier Jean Blanchard and Stanley Fischer, eds., NBER Macroeconomics Annual 1992, vol. 7 (Cambridge, Mass.: MIT Press), pp. 183-238. Return to text

6. See Milton Friedman and Anna Jacobson Schwartz (1963), A Monetary History of the United States, 1867-1960 (Princeton, N.J.: Princeton University Press), pp. 135-37. Return to text

7. See Ben S. Bernanke (2004), "Money, Gold, and the Great Depression," speech delivered at the H. Parker Willis Lecture in Economic Policy, Washington and Lee University, Lexington, Va., March 2. See also Barry Eichengreen (1996), Golden Fetters: The Gold Standard and the Great Depression, 1919-1939 (New York: Oxford University Press). During the Great Depression, some countries abandoned the gold standard because of the challenges associated with maintaining convertibility. This abandonment caused the public to be concerned about the commitment of other countries to the gold standard. To defend their commitment, these other countries were sometimes forced to raise interest rates, which further reduced economic activity and accentuated deflationary forces. This was the situation the Fed faced in 1931 when the departure of the United Kingdom from the gold standard caused concerns about the U.S. commitment to maintaining it. The action by the Fed to raise interest rates and defend the gold standard likely worsened the already serious economic downturn in the United States. Return to text

8. For example, the European Exchange Rate Mechanism--a managed system of exchange rate target zones among many Western European countries that preceded the creation of the euro--suffered a crisis in the early 1990s that caused severe economic downturns in some member countries. For a discussion of the challenges in maintaining a fixed exchange rate, see Stanley Fischer (2001), "Exchange Rate Regimes: Is the Bipolar View Correct?" speech delivered at the meetings of the American Economic Association, New Orleans, January 6. Return to text

9. Notably, commercial banks began to offer new types of deposits, and nonbank financial institutions, such as money market mutual funds, began offering close substitutes for bank deposits. The resulting changes in the behavior of financial institutions meant that expanding money at a constant pace could lead to an unstable path of inflation. See Charles Goodhart (1989), "The Conduct of Monetary Policy," Economic Journal, vol. 99 (June), pp. 293-346; for a review of the experience with money targeting in Group of Ten countries, see Linda S. Kole and Ellen E. Meade (1995), "German Monetary Targeting: A Retrospective View (PDF)," Federal Reserve Bulletin, vol. 81 (October), pp. 917-31. Return to text